What the evolution of wealth management means for Generation X and retirement

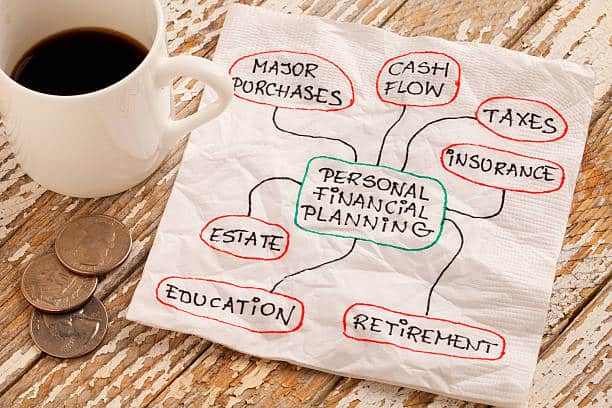

A recent financial literacy study from Investopedia shows Generation X (or Gen X) is invested in—and concerned about—retirement. Currently between 44 and 59 years old in 2024, Gen Xers recognize that it’s time to get serious about retirement savings. The study showed the top 3 worries for Gen Xers are retirement (21%), followed by [Read More]